Introduction

The Architecture, Engineering, and Construction (AEC) software market is experiencing a transformative era, driven by technological advancements, economic pressures, and evolving global demands. As we approach the end of 2025, the sector continues to demonstrate resilience and innovation, adapting to challenges like labor shortages, sustainability mandates, and digital integration. This article delves into the latest aec software news, highlighting key areas of growth, significant investments, and pivotal industry shifts. With projections indicating robust expansion, stakeholders are keenly observing how these elements interplay to shape the future of construction and design technologies.

The global AEC market, encompassing software solutions for design, project management, and collaboration, is valued at approximately $16.3 trillion in 2025, according to McKinsey reports. This figure underscores the industry’s scale, where software plays a crucial role in enhancing efficiency and reducing costs. Recent aec software news points to a compound annual growth rate (CAGR) of around 6-10% across various segments, fueled by the adoption of cloud-based platforms and artificial intelligence (AI). In this comprehensive overview, we’ll explore these dynamics in detail, drawing from market analyses, expert predictions, and real-world developments.

Market Growth: Accelerating Amid Digital Demands

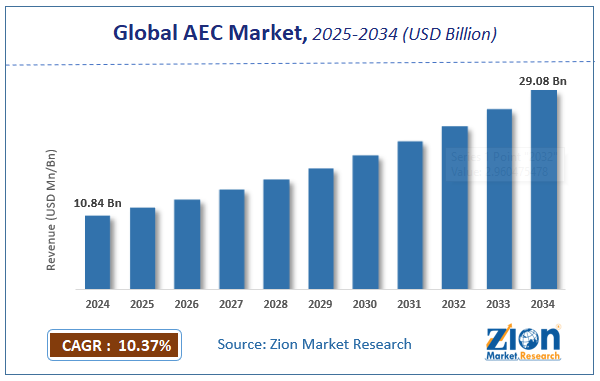

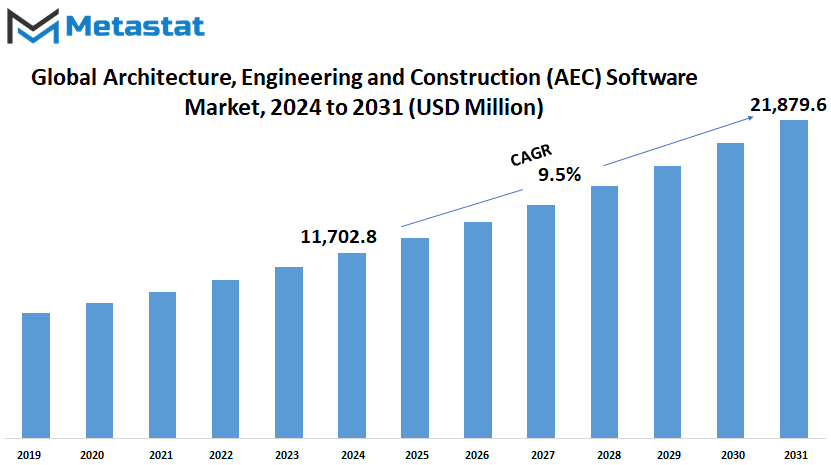

The AEC software market’s growth trajectory is one of the most compelling stories in recent aec software news. From 2023 to 2032, the market is expected to expand from $9.17 billion to $21.89 billion, achieving a CAGR of 9.7%, as per Custom Market Insights. More granular data from Mordor Intelligence estimates the market at $11.11 billion in 2025, projected to reach $16.95 billion by 2030 with an 8.8% CAGR. These figures reflect a broader trend where digital tools are no longer optional but essential for competitiveness.

Key drivers of this growth include the increasing complexity of projects, such as mega-infrastructure developments and urban expansions. Governments worldwide are investing heavily in public-private partnerships (PPPs), boosting demand for software that facilitates real-time collaboration and data management. For instance, Building Information Modeling (BIM) software has seen widespread adoption, enabling better visualization and error reduction in design phases. In North America alone, construction software revenues are set to surpass $4 billion in 2025, with a 9%+ CAGR over the next decade, according to Baird insights.

Sustainability is another catalyst. With regulations mandating carbon disclosures on public projects starting in early 2025 in several U.S. states, AEC firms are turning to software for eco-friendly design simulations. Generative AI, which optimizes resource allocation and predicts design flaws, is forecasted to grow at a 20% CAGR through 2032. This aligns with the industry’s push toward green building practices, including low-carbon materials and renewable energy integration.

Regionally, North America leads with approximately 40% of the global construction SaaS market share, driven by robust infrastructure spending of around $3 trillion. Europe follows closely, emphasizing sustainable urban development, while Asia-Pacific sees rapid growth due to urbanization and rising imports of AEC technologies. Challenges like economic uncertainty and supply chain disruptions persist, but the overall outlook remains positive. As per Deloitte’s 2026 Engineering and Construction Industry Outlook, investment in structures is expected to rebound with modest growth of nearly 1.8% in 2026, particularly in AI-related data centers.

In terms of specific segments, services within AEC software are outpacing pure software sales, growing at 11.1% annually. This shift underscores the value of hybrid models that combine tools with consultative services for process optimization. Small and medium-sized enterprises (SMEs) are increasingly adopting cloud deployments to scale operations without heavy upfront costs, further accelerating market expansion.

AEC Software Global Market Size, Share & Forecast to 2033

The above chart illustrates the projected global AEC software market size, highlighting the steady upward trend through 2033.

Investments: Fueling Innovation and Consolidation

Investments in the AEC software sector have surged, making headlines in aec software news throughout 2025. Venture funding, mergers, and acquisitions (M&A) are at the forefront, with North America capturing about 60% of global construction tech investments. A standout example is MatX’s $95 million Series A round in January 2025, the largest early-stage funding in the sector, aimed at developing cloud-native site automation tools.

M&A activity has been particularly robust, averaging around 100 transactions globally per year in 2024-2025. Notable deals include Verisk’s $2.4 billion acquisition of AccuLynx in July 2025, enhancing roofing and insurance software integration, and Nemetschek’s $770 million purchase of GoCanvas in July 2024, expanding mobile data capture capabilities. These moves reflect a strategic focus on platform consolidation, where companies seek to create unified systems for end-to-end project management.

Private equity (PE) firms are increasingly influential, accelerating M&A pace from Q4 2024 into 2025. According to Quire’s analysis, PE’s growing role is driven by the industry’s fragmentation and potential for value creation through synergies. The 2025 AEC M&A Outlook Report from Zweig Group highlights trends like rising buyer interest in sustainable tech and AI-driven solutions. Valuations remain strong, with relationship-driven acquisitions emphasizing cultural fit over pure financial metrics.

Equity financing is expected to gain momentum as macroeconomic conditions ease, per Capstone Partners’ report. Investors are targeting areas like embedded finance, which addresses cash flow issues in construction and is projected to grow at 30%+ CAGR globally from $80 billion in 2023 to $600 billion by 2030. Strategic partnerships, such as Nemetschek’s collaboration with MicroGenesis CADSoft in October 2024, aim to accelerate BIM adoption in emerging markets like India.

Labor shortages and productivity gaps are also drawing investments. With construction job openings 50% higher than pre-2020 levels, software that automates workflows and offsets scarcity is a hot spot. Robotics and extended reality (XR) technologies, including AR/VR/MR, are seeing influxes; the global XR market is projected at $250 billion by 2028 with a staggering 113.2% CAGR.

Overall, these investments signal confidence in the sector’s durability. As Baird notes, software can close 50-60% of the productivity gap in construction, where value added per worker lags behind other industries. This positions AEC software as a high-return area for investors, with continued emphasis on innovation to tackle real-world challenges.

AEC Market Size & Share | Industry Analysis 2034

This image depicts market share and growth projections for AEC software, emphasizing investment hotspots.

Industry Shifts: Toward Digital and Sustainable Futures

Industry shifts in the AEC software landscape are profound, as captured in the latest aec software news. Digital transformation tops the list, with 74% of AEC firms planning new tech implementations in 2025. Tools like digital twins, which simulate real-world assets to cut operating expenses by up to 35%, are becoming standard. Drones and 3D printing are also gaining traction, addressing efficiency in modular construction.

AI’s mainstream integration is a game-changer. Over 53% of architecture and engineering (A&E) firms now use AI for business development, proposal writing, and analytics, leading to a 50% median win rate in proposals—a sharp rise from previous years. Generative design, powered by AI, enables eco-friendly outcomes by exploring multiple options rapidly.

Sustainability mandates are reshaping priorities. With carbon disclosure requirements rolling out, firms are adopting software for low-carbon material tracking, LEED certifications, and water management systems like rainwater harvesting. The push for green spaces amid regulatory and economic demands is evident, with modular and volumetric construction addressing cost and quality issues.

Workforce dynamics are shifting too. 69% of firms face hiring challenges, with 89% struggling to find qualified workers amid an aging demographic and skills gaps in BIM and sustainable design. In response, 75% plan hiring increases, particularly in data centers and energy sectors, while 72% have embraced remote/flexible work. Diversity initiatives are on the rise to include underrepresented groups.

Proposal strategies have evolved, with submissions down 38% but awarded work value up 52%, focusing on high-value pursuits. Nonresidential construction is up 6% year-to-date, led by manufacturing and data centers, while residential dips 5%. Infrastructure remains critical, with the U.S. needing $9.1 trillion over the next decade for repairs, per the ASCE 2025 Report Card.

Globally, Europe leads in AEC exports (over 40%), while Asia-Pacific’s rapid urbanization drives imports. These shifts underscore a move toward resilient, tech-enabled practices that prioritize sustainability and efficiency.

Architecture, Engineering, and Construction (AEC) Software Market Size, Insights, Evaluation & Forecast 2033

The chart above shows AEC software market insights and evaluations through 2033.

Architecture, Engineering and Construction (AEC) Software Market, 2031

This visualization captures AEC software market trends up to 2031.

Conclusion

In summary, the AEC software market is poised for sustained growth, bolstered by strategic investments and adaptive shifts. As aec software news continues to evolve, stakeholders must stay agile to leverage opportunities in AI, sustainability, and digital tools. The projected expansions signal a vibrant future, where innovation meets practical needs to build a more efficient world.

FAQ

What is driving the growth in the AEC software market?

Growth is primarily driven by digital transformation, AI adoption, and sustainability mandates. Market projections show a CAGR of 8.8-10.3% through 2030-2034, with values reaching $16.95 billion to $26.79 billion.

How significant are investments in AEC software in 2025?

Investments are robust, with notable fundraises like MatX’s $95 million and M&A deals exceeding 100 annually. Private equity is increasingly active, focusing on tech integration and value creation.

What key industry shifts are occurring?

Shifts include AI mainstreaming (53% adoption), sustainability focus with carbon disclosures, and workforce adaptations to labor shortages through flexible models and skills training.

Which regions lead in AEC software market growth?

North America holds the largest share (~40% of global SaaS), followed by Europe and Asia-Pacific, driven by infrastructure spending and urbanization.

What future trends should AEC firms watch?

Watch for generative AI, modular construction, XR technologies, and embedded finance, all set to grow rapidly and transform project delivery.

AEC Software Market Size & Share Analysis – Industry Research Report – Growth Trends 2030